Loan solutions - for all your needs

Not infrequently, it is practical to take out a loan or to realize a special financing. Nowadays, a wide range of financing types are available to you at bestfinance.ch.

We bring the relevant expertise and can support you with convincing financing solutions.

Documents required for your loan application

Your loan request will be processed immediately and a loan offer will be submitted within 24 hours.

But this will only succeed if your documents are complete.

Checklist of documents:

- valid identification

- for non-Swiss foreigner's permit B, C or G

- the 3 most recent payslips

- if you want to redeem a loan, a copy of the loan agreement

- valid identification

- for non-Swiss foreigner's permit B, C or G

- the 3 most recent payslips

- if you want to redeem a loan, a copy of the loan agreement

- the same documents of the spouse

- valid identification

- for non-Swiss foreigner's permit B, C or G

- the 3 most recent payslips

- Divorce Decree

- the last 3 bank credits for alimony (if available)

- if you want to redeem a loan, a copy of the loan agreement

- valid identification

- for non-Swiss foreigner's permit B, C or G

- the 3 most recent payslips

- Separation judgement or separation agreement

- the last 3 bank credits for alimony (if available)

- if you want to redeem a loan, a copy of the loan agreement

- valid identification

- for non-Swiss foreigner's permit B, C or G

- the 3 most recent payslips

- the 3 most recent credit notes (widow's pension if available)

- latest widow's pension order

if you want to redeem a loan, a copy of the loan agreement

- valid identification

- for non-Swiss foreigner's permit B, C or G

- the 3 most recent credit memos (pension receipt)

- latest pension ruling

- if you want to redeem a loan, a copy of the loan agreement

- valid identification

- for non-Swiss foreigner's permit B, C or G

- the last definitive tax assessment

- min. 2 years self-employed

- if you want to redeem a loan, a copy of the loan agreement

- valid identification

- for non-Swiss foreigner's permit B, C or G

- the 12 most recent pay slips

- if you want to redeem a loan, a copy of the loan agreement

Increase your chances of getting a loan

Send these additional documents, if applicable:

For people who live in a shared flat or in cohabitation, we need a copy of the tenancy agreement

better scoring

60%

For persons with premium reduction, we require a copy of the health insurance policy and the premium reduction decree

Better credit rating

40%

For house or flat owners, we need a copy of the mortgage contract

Lower credit interest rates

100%

You have several options for sending us the documents:

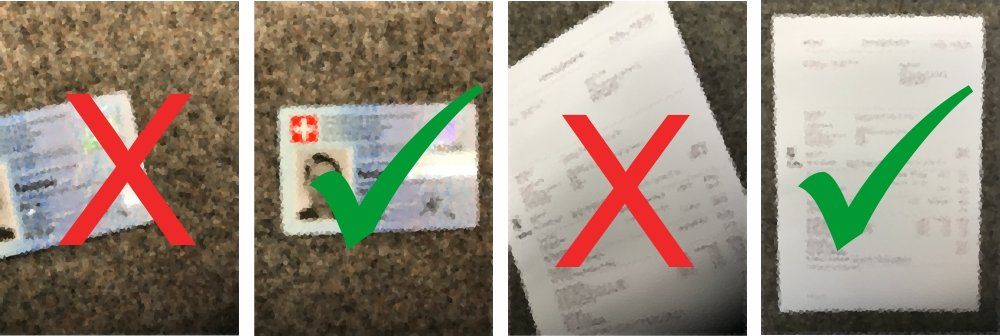

Photographing documents - how to do it right

- To take photos, you need light above all else, and preferably a lot of it. Therefore, good lighting is a basic prerequisite for a usable document copy.

- Do not photograph too close, as the picture may become blurred.

- Leave a small margin on each side of the image so that you do not cut off any text.

- If you follow the example below, you will take perfect document photos.

- We recommend the free Microsoft Lens app to turn your device into a powerful mobile scanner

Microsoft Lens IOS

Microsoft Lens ANDROID

If you have any further questions about our products and services, please contact us:

D. Ferraro

062 823 08 03

Credit enquiry with several banks

Credit comparison, yes, but be careful with credit enquiries.

Today, there are numerous credit offers of all kinds on the Internet.

The first thing they do to check your creditworthiness is to make an enquiry with the ZEK. The enquiries then accumulate there.

These enquiries can remain stored in the ZEK for up to 2 years and can be viewed by other banks.

Multiple credit enquiries can have a negative effect on the score and can even lead to a rejection.

It is therefore important not to make several enquiries at once.